How Interest Rates Can Influence Financial Decisions

Topic:

Few Aspects of Economy Have as Much Effect on Spending, Saving

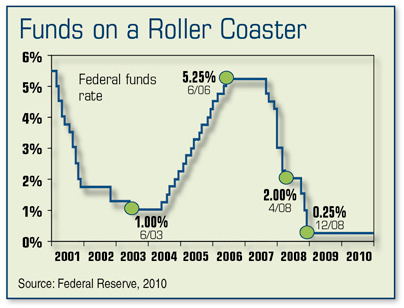

Throughout much of the past decade, the Federal Reserve has relied on its control of short-term interest rates to influence economic activity. Some would even say that it has made some fairly unconventional moves: Like cutting the federal funds rate 11 times in 2001. Or keeping rates under 2% for much of the decade. Or taking them almost to zero in response to the 2008 credit crisis, along with other monetary moves designed to push down long-term rates.1–2

On the surface, adjusting interest rates might seem to be an overly simple solution for steering the world’s most powerful economy: Growing slowly or not at all? Cut interest rates. Growing too fast? Raise interest rates. Economy seems fine? Leave rates alone.

The reality is that there are few mechanisms in any economy that can influence behavior more effectively than interest rates. Consider how low interest rates can affect important financial decisions.

Decisions About Spending and Saving

Low interest rates create incentives for people and businesses to spend money, especially on purchases that may require financing. Interest rates directly affect borrowing costs, so lower rates may help increase the affordability of big-ticket items, such as automobiles and real estate. For example, home sales tend to be higher when mortgage rates are 5% than when they are 10%.3

The Fed’s primary motivation for cutting interest rates is usually to stimulate spending. Lowering rates may help encourage businesses to purchase capital goods and durable equipment; households may find that they are able to purchase items that were previously out of reach.

By contrast, higher interest rates reduce incentives to spend and increase the potential benefits of saving. In theory, higher interest rates dampen consumer demand. If the supply of goods and services remains the same, then the result should be less upward pressure on prices — in other words, less inflation.

Decisions About Debt Maturities

When short-term interest rates are low relative to long-term rates, it raises the risk that institutions and individuals seeking to own debt may overinvest in bonds with longer maturities in an attempt to increase yields. If interest rates rise, the value of existing bonds can be expected to fall. The longer the maturity, the greater the effect may be on the value of the bond. The principal value of bonds fluctuates with market conditions. Bonds redeemed prior to maturity may be worth more or less than their original cost.

Decisions About Risk

When rates are low, investors may turn to higher-risk investments in pursuit of greater return potential. Over longer periods, more investors may be lured to riskier positions until an unhealthy percentage of economic resources is exposed to too much risk. The more economic resources that are pursuing speculative investments, the greater the risk that a financial crisis could occur.

We’re likely to see low interest rates persist for the foreseeable future. When it comes to your portfolio, it’s important to strike a balance between making decisions based on your long-term interests and making decisions based on the current influence of interest rates.

1, 3) Federal Reserve, 2010

2) The Wall Street Journal, November 4, 2010

Alexander Parris, Financial Advisor

Financial Securities Services, LLC, 600 E. Jefferson St., Suite 312, Rockville, MD 20852

Tel 301-838-0105, Fax 301-560-4942

AParris@FinancialSecuritiesServices.com