European News Causes Market Mood Swings

Topic:

The U.S. economy started to gain some momentum in the second half of 2011.1 Nevertheless, investor confidence may depend in large part on how events unfold in Europe, as any deterioration in the two-year-old debt crisis could present a significant obstacle for an economic recovery here.

In recent weeks, yields on 10-year Italian bonds spiked to 7.4%, suggesting that the sovereign debt crisis was spreading into larger economies and eluding the efforts of the European Union (EU) to contain it.2 After bond yields in Portugal and Ireland exceeded 7%, they were forced to seek financial bailouts.

Despite higher borrowing costs, Italy is still solvent and should be able to meet its obligations in the short term. Fiscal and economic reforms may help improve the nation’s longer-term prospects. However, the fear that the EU would not have enough money to rescue Italy — as it has other beleaguered nations including Greece, Ireland, and Portugal — is a significant cause for concern.3

Some uncertainty also remains as to whether the government in Greece will push through strict austerity measures as a condition to remain in the eurozone. If faced with a disorderly default, Greece is likely to abandon the euro, and the conversion to cheaper drachmas could result in a run on banks.4

Many U.S. investors are concerned that if Europe falls into a deep recession, it could take a toll on U.S. exports. And in the event of widespread defaults, large European financial institutions could suffer major losses. The threat of bank failures along with a large-scale credit contraction could result in another global financial crisis.5

A Single-Minded Obsession

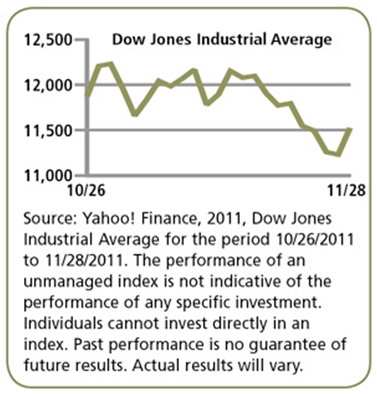

The unpredictable nature of government policies has been weighing heavily on the financial markets. Consider how the following news events prompted dramatic stock market moves in the United States.

October 31–November 1: Greek Prime Minister George Papandreou plans public referendum for rescue terms. Dow falls 4.69%.8–9

November 2–3: Greek referendum canceled and European Central Bank cuts interest rates. Dow rises 3.32%.10–11

November 9: Yields on Italian bonds surpass the 7% level that triggered bailouts for other nations. Dow falls 3.19% in one day.12–13

November 10–11: Italy passes austerity measures, and Prime Minister Silvio Berlusconi departs; Greece seats new prime minister. Dow rises 3.16%.14–15

November 16–17: Fitch Ratings agency warns that U.S. banks are sizably exposed to European sovereign debt. Dow falls 2.69%.16–17

Political Uncertainty Rules

Europe’s problems may stem from the fact that a common currency and economic zone were established without a means to ensure that member nations adopt consistent fiscal policies. As a result, economic weakness and high sovereign debt levels sparked a series of political crises over the last year and led to the fall of governments or leaders in more than five EU countries.18

It is widely believed that the eurozone will either establish a more powerful central body or begin to break apart. It could take many months or even years for European leaders to restore financial stability, so related market volatility may continue for some time.19

Political crises are macroeconomic risks that also tend to cause the prices of stocks and other investments to move in sync, temporarily eschewing the fundamental factors and valuations that typically drive individual security prices.

2–3, 12) The Wall Street Journal, November 9, 2011

4) Associated Press, November 16, 2011

5) CNN.com, November 14, 2011

6) CNN.com, October 27, 2011

7, 9, 11, 13, 15, 17) Yahoo! Finance, Dow Jones Industrial Average for the period 10/26/2011 to 11/28/2011

8) The Wall Street Journal, November 1, 2011

10) The Wall Street Journal, November 3, 2011

14) CNNMoney, November 11, 2011

16) The New York Times, November 16, 2011

18–19) Los Angeles Times, November 10, 2011

Financial Securities Services, LLC, Summit Brokerage Services, Inc., Summit Financial Services, Inc. and its affiliates do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your situation.